To find out, Newsday had the consulting and research firm Energage anonymously poll more than 11,000 employees at 82 LI employers, on everything from pay and benefits to leadership and company alignment.

After analyzing all the results of the 82 companies that participated in the survey, Newsday and Energage have selected 66 as top Long Island workplaces and we are proud to spotlight the winners in each category, along with a look at what their employees had to say, islandwide trends and much more.

Large Employers

500+ Long Island workers

TOP LARGE EMPLOYER NEW YORK LIFE – LONG ISLAND

LARGE EMPLOYER RUNNER-UP BNB Bank

LARGE EMPLOYER 2ND RUNNER-UP PIPING ROCK HEALTH PRODUCTS

Adults and Children with Learning & Developmental Disabilities, Inc. (human and social services) “I know my job affects the people that I support, and I feel really good after getting something accomplished.”

BNB Bank “Senior leadership is always available to me. If I need to talk to someone through a phone call or email, it is always taken. This is not usually the case at other banks.”

Cold Spring Harbor Laboratory (research) “I feel that I’m contributing in a very small way to the betterment of our world through the scientific research done at the lab.”

Family Service League Inc. (human and social services) “When you can help someone, who has lost a loved one to suicide, and then be supported by colleagues after the emotional intervention – even if it’s in the evening or on a weekend – you know you are part of a great team and you’re working in the right place.”

New York Cancer & Blood Specialists (health care) “Knowing that I’m making a difference in someone’s life during the tough time they are going through is so very rewarding to me. This job has made me decide to go back to school this fall and I am hoping to move in this company and become a nurse one day!”

New York Life – Long Island “I have real pride for the work I do helping clients with their finances and putting safety measures in place for the unexpected. My family and friends were underinsured before I started this career.”

Piping Rock Health Products, LLC (vitamins and nutritional supplements) “The production of vitamins is very interesting, and the company is growing a lot because it is making the best decisions.”

Stony Brook Southampton Hospital “I grew up in this town, so I know quite a few of the patients and enjoy caring for them. I feel like management really cares about all the employees and our safety.”

WellLife Network Inc. (social services and addiction recovery) “I am caring for children that need mental health support. This is very important to me as a social worker and is why I went into this profession.”

Zebra Technologies Corp. (barcode scanners, printers and mobile computers) “Open and transparent communications from upper management allow me to be proactive in planning my work and family life accordingly, especially during this pandemic.”

| Rank | Employer | Founded | Ownership | Sector | Headquarters City | HQ state | LI Locations | LI Employees |

|---|---|---|---|---|---|---|---|---|

| 1 | New York Life – Long Island | 1845 | Cooperative/Mutual | Financial planning | Melville | NY | 5 | 779 |

| 2 | BNB Bank | 1910 | Public | Community bank | Bridgehampton | NY | 34 | 505 |

| 3 | Piping Rock Health Products, LLC | 2011 | Private | Manufacturing | Bohemia | NY | 8 | 572 |

| 4 | Family Service League. Inc. | 1926 | Private | Human and social services | Huntington | NY | 25 | 815 |

| 5 | Zebra Technologies Corp. | 1969 | Public | Technology | Lincolnshire | IL | 1 | 946 |

| 6 | Cold Spring Harbor Laboratory | 1890 | Non-profit | Research | Cold Spring Harbor | NY | 1 | 943 |

| 7 | Stony Brook Southampton Hospital | 1909 | Non-profit | Hospitals | Southampton | NY | 1 | 1,330 |

| 8 | New York Cancer & Blood Specialists | 1985 | Partnership | Health care | Port Jefferson Station | NY | 15 | 875 |

| 9 | WellLife Network Inc | 1980 | Private | Children, family, human services | Smithtown | NY | 12 | 550 |

| 10 | Adults and Children with Learning & Developmental Disabilities, Inc. | 1957 | Non-profit | Human and social Services | Bethpage | NY | 100 | 938 |

Midsize Employers

150-499 Long Island workers

TOP MIDSIZE EMPLOYER HEALTH CARE PARTNERS, MSO

MIDSIZE EMPLOYER RUNNER-UP EXIT REALTY ACHIEVE

MIDSIZE EMPLOYER 2ND RUNNER-UP POWER HOME REMODELING

Association for Mental Health and Wellness (human and social services) “My job enables me to provide necessary support to clients to enhance their motivation and confidence, and to educate them on how to find resources to help them succeed that they would otherwise not receive.”

CN Guidance & Counseling Services (human and social services) “We get to help those people in the community that need help, and we do it with a great team.”

Darby Dental Supply, LLC “I look around and see all the employees that have been here for 10, 20 and 30-plus years. I think that alone speaks volumes about how this is a very fair and rewarding company.”

EXIT Realty Achieve (real estate) “Helping a family make one of the most important decisions in their lives, being able to guide them correctly, and seeing how it makes them happy is amazing.”

Family & Children’s Association (social services) “We are a family who strives to be our very best for those who need us.”

Grassi Advisors & Accountants “I love my job because I get to utilize my accounting skills and work with professionals and clients that I can learn from.”

H2M Architects + Engineers “My ideas are respected, and I am given space to explore them further.”

HealthCare Partners, Management Service Organization “Our president, Dr. Robert LoNigro, hosts weekly webinars to let us know how the organization is doing. He encourages us to ask questions and provides honest answers to those questions.”

Kimco Realty Corp. (commercial real estate) “I love my job because of the good that I am able to do in getting tenants into a space which provides a livelihood for them.”

Marcum LLP (accounting) “Senior managers allow us to ask questions and don’t just expect us to do things a certain way because ‘that’s how it’s always been done.’ ”

Options for Community Living Inc. (housing and other services for vulnerable populations) “I feel like I’m making a difference in our clients’ lives and an impact on the surrounding community.”

Posillico (construction) “The coronavirus put a serious stress on all and senior managers tried to ensure all could work as safe as possible as we are deemed essential workers.”

Power Home Remodeling “My managers allow me to fail and get back up stronger. They have trust in me and I have trust in them. The work environment is never negative.”

Precipart (components manufacturing) “I love my job because I am able to produce quality parts which help the world.”

Spellman High Voltage Electronics Corp. (manufacturing) “I get to work with great people on interesting projects.”

SUNation Solar Systems (solar panel installation) “CEO Scott Maskin comes in singing most days. It’s a fun place to work and we do a lot of good for the local community by donating solar energy systems and rescuing dogs.”

| Rank | Employer | Founded | Ownership | Sector | Headquarters City | HQ state | LI Locations | LI Employees |

|---|---|---|---|---|---|---|---|---|

| 1 | HealthCare Partners, MSO | 1996 | Private | Health care | Garden City | NY | 1 | 240 |

| 2 | EXIT Realty Achieve | 2010 | Private | Real estate agents/brokers | Smithtown | NY | 1 | 173 |

| 3 | Power Home Remodeling | 1992 | Private | Home remodeling | Chester | PA | 1 | 217 |

| 4 | Posillico | 1946 | Private | Construction | Farmingdale | NY | 1 | 264 |

| 5 | Kimco Realty Corp. | 1958 | Public | Commercial real estate investment trust | Jericho | NY | 1 | 226 |

| 6 | Association for Mental Health and Wellness | 1990 | Non-profit | Mental health and wellness | Ronkonkoma | NY | 8 | 198 |

| 7 | Marcum LLP | 1951 | Partnership | Accounting and consulting advisors | New York | NY | 1 | 187 |

| 8 | Spellman High Voltage Electronics Corp. | 1947 | Private | Manufacturing | Hauppauge | NY | 1 | 315 |

| 9 | Grassi Advisors & Accountants | 1980 | Private | Accounting | Jericho | NY | 2 | 211 |

| 10 | SUNation Solar Systems | 2003 | Private | Renewable energy | Ronkonkoma | NY | 1 | 174 |

| 11 | Family & Children’s Association | 1884 | Non-profit | Human services | Mineola | NY | 11 | 218 |

| 12 | Darby Dental Supply, LLC | 1947 | Private | Dental supply sales and services | Jericho | NY | 1 | 174 |

| 13 | H2M architects + engineers | 1933 | Private | Architectural and engineer design services | Melville | NY | 2 | 348 |

| 14 | Options for Community Living, Inc. | 1982 | Private | Human services | Ronkonkoma | NY | 3 | 218 |

| 15 | CN Guidance & Counseling Services | 1972 | Non-profit | Mental health | Hicksville | NY | 3 | 277 |

| 16 | Precipart | 1950 | Private | Engineering and manufacturing | Farmingdale | NY | 1 | 285 |

Small Employers

50 – 149 Long Island workers

TOP SMALL EMPLOYER NATIONAL BUSINESS CAPITAL & SERVICES

SMALL EMPLOYER RUNNER-UP NETWORK SOLUTIONS AND TECHNOLOGY

SMALL EMPLOYER 2ND RUNNER-UP TOTAL TECHNOLOGY SOLUTIONS

A+ Technology and Security Solutions Inc. (security systems) “We keep kids safe and help give a little comfort in a sometimes-uncomfortable world.”

Above All Store Fronts, Inc. (construction) “The company encourages new ideas and allows me to challenge myself in additional areas to do what I can to help my department grow and become more efficient.”

American Portfolios Financial Services Inc. (broker/dealer) “We are encouraged to do good things in our own town. It’s unlike any other company that I’ve been a part of.”

Appliance World (retailing) “Everyday, I feel proud to work here and be a part of something that is growing at a rapid pace. I’m believed in by my leaders and am well compensated.”

Aurora Contractors, Inc. (construction) “Employees are constantly looking for new exciting and active ways to come together and have fun, such as company picnics, badminton tournaments, rock climbing, bowling and game nights.”

Austin Williams (advertising) “There is occasionally some healthy critique of the work that I produce. Sometimes I’m asked, ‘Why not this way or why not that way?’ Usually I have an answer but sometimes I don’t. I find this healthy criticism extremely helpful because although I believe I’m very good at what I do. I’m far from perfect.”

BBS Architects, Landscape Architects & Engineers, P.C. “I love my job because I get to design spaces that support the education of our youth.”

Blue Ocean Wealth Solutions, a Mass Mutual Firm (insurance) “My job allows me to impact the lives of my clients in a very positive and meaningful way because I’m giving them lifelong financial advice.”

College H.U.N.K.S. Hauling Junk and Moving “It feels good to help others during a stressful move and provide professionalism and promote positivity during the move.”

DUKAL Corp. (medical devices) “I have never been treated better by any employer and I’ve been in health care sales for nearly 25 years.”

Engel Burman (real estate development) “I love my job because I participate in building great things that help people, and I enjoy the process.”

Future Tech Enterprise (information technology) “At the beginning of the stay-at-home, CEO Bob Venero called me to see how I was doing. It meant the world to me that he took time out of his busy schedule to see how I was doing.”

Greenman-Pedersen, Inc. (engineering) “I love my job because I have the opportunity to work on amazing structures and follow my passions in bridge building.”

Janover LLC (accountants) “I am able to assist clients in making the right decisions for their businesses based on accurate financial information.”

KidsFirst Evaluation and Advocacy Center (special education) “Never in my wildest dreams could I have imagined working with a company that allows me to work within and through some of my own limitations.”

Lewis Johs Avallone Aviles LLP (attorneys) “The firm allows me to practice law in a professional nonrestrictive environment.”

Long Island Select Healthcare, Inc. (medical clinics) “I get to help care for people who need help, those who live in the community that I live in. For this I am proud.”

Louis K McLean Associates Engineers & Surveyors, PC (civil engineering) “I love my job because I’m able to grow in knowledge of the things that I care about and gain experiences in many areas of engineering.”

McIntyre, Donohue, Accardi, Salmonson, and Riordan, LLP (attorneys) “My job allows me to do a great public service helping injured workers.”

Meadowbrook Financial Mortgage Bankers Corp. “I make people happy when I can help them obtain a home.”

Mercy Haven, Inc. (human and social services) “I love my job because I get to help people in need and give back to the community.”

National Business Capital & Services (small business lending) “I feel like I am at my second home with a family that all has a similar goal: to create a smooth and efficient business financing platform for business owners and partners to take advantage of.”

National Consumer Panel (researchers) “I work without feeling pressured and at the end of the day, I don’t worry about not wanting to go back to work the next day. I always look forward to it.”

Network Solutions & Technology (information technology) “I like solving problems and providing positive business outcomes. I need to listen to my clients’ obstacles and find some way to help them overcome their issues.”

New Vitality (vitamins and nutritional supplements) “There is a level of trust to make my own decisions, but managers are always available to help find the right route. We are helping people live better and stay healthy.”

NY State Solar (solar panel installation) “Work feels like a second family, especially after a company trip to Greece at the end of 2019. It was the best time of my life.”

Plesser’s Appliances (retailing) “I get along with all of my coworkers and work in one of the busiest appliance stores in the country.”

P.W. Grosser Consulting (engineering) “I am so proud to work for a company that works towards a greener, more sustainable future.”

Prepaid Ventures, Ltd. (financial technology) “I am trusted and valued for the work that I do, and they show their appreciation. Everyone works as a team, which helps us grow as a business.”

Reverse Mortgage Funding LLC “I love helping seniors make a better life for themselves. Reverse Mortgage Funding is a nice working environment with nice people, lots of laughs and some tears – just like a second family.”

SAIL, Inc. (human and social services) “We are helping individuals change the course of their lives in a positive way.”

Stasi Brothers Asphalt & Masonry “I am respected for my abilities and given the opportunity to change things that need to be improved. They treat us all like family and go above and beyond what most bosses would do.”

SupplyHouse.com (plumbing, heating and ventilation supplies) “It doesn’t feel like my company would ever step on us or try to take anything away from us just to make a profit, and I feel like every decision they make is good for our customers and for us.”

Total Technology Solutions (information technology) “As an IT company that operates 24/7 in the pandemic, it is imperative that we continue to support local governments as well as our other clients consisting of law firms, accounting firms and many more.”

Transervice Logistics Inc. (transportation) “My job is never dull. There is continued growth, trust and appreciation from management and the employees.”

Tweezerman International (personal care products) “I feel like I’m valued and my opinion matters.”

United Northern Mortgage Bankers Limited “I am encouraged to become better at my job. The company pays for my training and gives me the time off to take it.”

United States Luggage Company (wholesale distributor) “People are treated like human beings here and not like some replaceable automaton. Ideas are welcome and encouraged. Positive energy is something commonplace here.”

VHB Engineering, Surveying, Landscape Architecture and Geology, P.C. “I feel like I play a vital and appreciated role in significant projects, and I feel like I have the proper room and encouragement to continue growing my career.”

Yardi Systems, Inc. (real estate software) “The company encourages you to find your niche so if you are not feeling challenged in your current environment. Their approach is ‘where do you see yourself?’ and then they help you to achieve that goal.”

| Rank | Employer | Founded | Ownership | Sector | Headquarters City | HQ state | LI Locations | LI Employees |

|---|---|---|---|---|---|---|---|---|

| 1 | National Business Capital & Services | 2007 | Private | Business financing | Bohemia | NY | 1 | 87 |

| 2 | Network Solutions and Technology (NST) | 2001 | Private | Information technology | East Northport | NY | 1 | 54 |

| 3 | Total Technology Solutions | 1988 | Private | Information technology, cybersecurity | Melville | NY | 1 | 50 |

| 4 | Aurora Contractors, Inc. | 1983 | Private | Construction management | Ronkonkoma | NY | 1 | 53 |

| 5 | Blue Ocean Wealth Solutions, a Mass Mutual Firm | 1851 | Cooperative/Mutual | General insurance | East Hills | NY | 1 | 140 |

| 6 | SupplyHouse.com | 2004 | Private | E-commerce | Melville | NY | 1 | 135 |

| 7 | American Portfolios Financial Services Inc. | 2001 | Private | Broker/dealer | Holbrook | NY | 1 | 117 |

| 8 | McIntyre, Donohue, Accardi, Salmonson, and Riordan, LLP | 1955 | Private | Workers’ compensation | Bay Shore | NY | 2 | 54 |

| 9 | United Northern Mortgage Bankers Limited | 1979 | Private | Mortgage lending | Levittown | NY | 1 | 108 |

| 10 | DUKAL Corp. | 1991 | Private | Medical Devices & Products | Ronkonkoma | NY | 1 | 65 |

| 11 | Yardi Systems, Inc. | 1984 | Private | Custom Software Development & Consulting | Santa Barbara | CA | 1 | 149 |

| 12 | P.W. Grosser Consulting | 1990 | Private | Environmental engineering | Bohemia | NY | 1 | 50 |

| 13 | Future Tech Enterprise | 1996 | Private | Information technology | Holbrook | NY | 1 | 110 |

| 14 | United States Luggage Company | 1911 | Private | Wholesale distributor | Hauppauge | NY | 1 | 65 |

| 15 | Janover LLC | 1938 | Private | Certified public accountants | Garden City | NY | 1 | 99 |

| 16 | Stasi Brothers Asphalt & Masonry | 1962 | Private | Construction | Westbury | NY | 1 | 70 |

| 17 | Lewis Johs Avallone Aviles, LLP | 1993 | Private | Law | Islandia | NY | 1 | 145 |

| 18 | NY State Solar | 2015 | Private | Solar | Hicksville | NY | 3 | 86 |

| 19 | Transervice Logistics Inc. | 1969 | Private | Transportation | Lake Success | NY | 1 | 61 |

| 20 | Louis K McLean Associates Engineers & Surveyors, PC | 1950 | Private | Civil engineering | Brookhaven | NY | 2 | 85 |

| 21 | A+ Technology and Security Solutions Inc. | 1989 | Private | Value Added Reseller – Information Technology | Bay Shore | NY | 1 | 83 |

| 22 | Appliance World | 1992 | Private | Appliances | Huntington | NY | 2 | 62 |

| 23 | National Consumer Panel | 2010 | Private | Data analysis & research | Syosset | NY | 1 | 75 |

| 24 | Reverse Mortgage Funding LLC | 2012 | Private | Reverse mortgages | Bloomfield | NJ | 1 | 68 |

| 25 | College H.U.N.K.S. Hauling Junk and Moving | 2011 | Private | Moving and junk removal | Tampa | FL | 1 | 99 |

| 26 | Meadowbrook Financial Mortgage Bankers Corp. | 2010 | Private | Mortgage lending | Westbury | NY | 2 | 125 |

| 27 | New Vitality | 1998 | Public | Multivitamin supplements | Edgewood | NY | 1 | 59 |

| 28 | MSH Inc. dba Plesser’s Appliances | 1919 | Private | Electronics & appliances | Babylon | NY | 3 | 50 |

| 29 | SAIL, Inc. | 1982 | Private | Human and social services | Baldwin | NY | 7 | 132 |

| 30 | KidsFirst Evaluation and Advocacy Center | 1997 | Private | Special education support services | Deer Park | NY | 2 | 90 |

| 31 | Austin Williams | 1982 | Private | Advertising | Hauppauge | NY | 1 | 50 |

| 32 | Prepaid Ventures, Ltd. | 2007 | Private | Financial services | New Hyde Park | NY | 1 | 50 |

| 33 | BBS Architects, Landscape Architects, & Engineers, P.C. | 1985 | Private | Architecture & engineering | Patchogue | NY | 1 | 63 |

| 34 | VHB Engineering, Surveying, Landscape Architecture and Geology, P.C. | 1979 | Private | Engineering and designing services | Watertown | MA | 1 | 62 |

| 35 | Mercy Haven, Inc. | 1985 | Non-profit | Human and social services | Islip Terrace | NY | 5 | 77 |

| 36 | Above All Store Fronts, Inc. | 1993 | Private | Construction | Hauppauge | NY | 1 | 80 |

| 37 | Greenman-Pedersen, Inc. | 1966 | Private | Construction | Babylon | NY | 2 | 130 |

| 38 | Engel Burman | 1997 | Private | Real estate development | Garden City | NY | 2 | 71 |

| 39 | Long Island Select Healthcare, Inc. | 2016 | Private | Health services | Central Islip | NY | 6 | 113 |

| 40 | Tweezerman International | 1980 | Private | Beauty products | Port Washington | NY | 1 | 115 |

Special Awards

Companies that employees scored highest in each category

Leadership (large)

Karen Boorshtein

Family Service League

Leadership (midsize)

Dr. Robert LoNigro

HealthCare Partners, MSO

Leadership (small)

Vincent Tedesco

Total Technology Solutions

Direction Piping Rock Health Products

Managers Power Home Remodeling

New ideas National Business Capital & Services

Doers College H.U.N.K.S. Hauling Junk and Moving

Meaningfulness Aurora Contractors, Inc.

Values Network Solutions and Technology

Clued in senior management BNB Bank

Communication Zebra Technologies Corporation

Appreciation Posillico

Work/life flexibility McIntyre, Donohue, Accardi, Salmonson, and Riordan, LLP

Training Association for Mental Health and Wellness

Benefits Cold Spring Harbor Laboratory

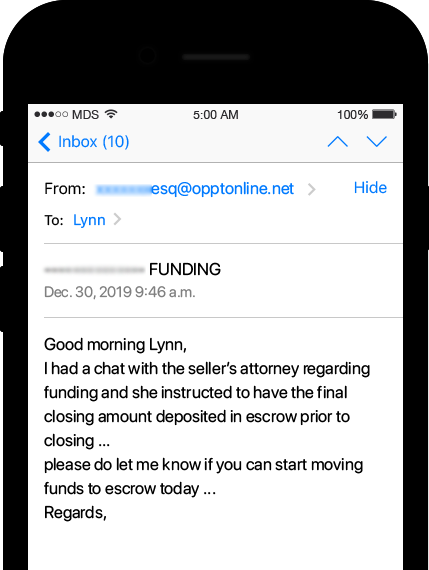

Find a top workplace

There’s a Top Workplace near you no matter where you are on LI

The Methodology

Facing adversity

Home office

Working from home isn’t easy, but these Long Islanders are making it work.

Ruff day at the “home” office?

Never, Suzy Silverstein might say. Silverstein, a project manager at VHB Engineering, set up her workspace on her pool deck in the company of her favorite four-legged colleagues, Bubbles, a dachshund, and Blanket, a two-year-old Juliana mini pig, who also goes by Blanky, Blankarooni or Blankisaurus.

Those not fortunate enough to work poolside created variations of their “home office” space, some making do with makeshift desks and chairs, others claiming their “corner office” in quiet, kid-free, no-traffic zones in their den, kitchen, bedroom, basement, or other spaces.

A Huntington Station woman, Pattie Dougherty, of H2M Architects + Engineers, designed her own mobile space — in the back of her SUV.

Now, can you take breaks when working from home? One employee found a quick minute to stretch her legs, while others sought company with their kids, sometimes giving crying babies a lift.

Working from the “home” office sure has its perks. You can go Friday casual or wear a tie. Suit yourself. And when you can finally take that much-delayed staycation to spend time with your two-legged companions (socially distanced, of course) you can even set your email to say: I will be out of the (home) office until next week.

Oh, another perk of working from home: You don’t have to deal with those petty office pet peeves. (But if you’re seriously wondering whether Bubbles and Blanky get along, you may just have to get back to the office.)

— LEEMA THOMAS

Heroes

Some employees went the extra mile, according to the employers who nominated their staff as workplace heroes.

The state went on pause but the pandemic kept many employees on their toes, with some going the extra mile, according to the employers who nominated their staff as workplace heroes.

One employee initiated a wellness series for colleagues.

Another not only continued to work in the office despite her compromised immune system as a cancer survivor but she also started a food drive, and then drove around distributing food and supplies to hospital workers and cancer patients, her employer said.

Across companies on Long Island, these workers rose to the occasion and were recognized for their passion and dedication, for their philanthropy and volunteerism, for helping their businesses survive and thrive.

One even used his creative skills to help design a face covering for employees to return to the office.

— Leema Thomas

Determination

Although COVID-19 put a brake on many business operations, a number of Long Islanders across various sectors, showed up to work — in their offices or in the field — in PPE gear.

Call it the pandemic couture.

Although COVID-19 put a brake on many business operations, a number of Long Islanders across various sectors, showed up to work — in their offices or in the field. While business was surely not as usual, these employees stepped up to the (fashion) plate, dressing for style, health and success.

Employees — from doctors, nurses, accountants, architects, engineers, mental health and social service workers, volunteers and even summer interns — kept the business engine running, suited up in various personal protective gear including facial coverings, masks, gloves, N95 respirators and other accessories, mindful of following health-mandated protocols.

Some like Carlos Vargas, landscape architecture team leader at VHB Engineering, worked alone in the field.

Others like Ayodeji Grace Oloke, Alexandria Attivissimo, Taylor Alicanti, Ama Serwah and Christina Metz, all employees at CN Guidance & Counseling Services, worked in the office.

Yet others like Greg Genovese and Alison Longstreet, both employees at New York Life Insurance Co., outfitted in their PPE, delivered meals to the “overnight crew” at a hospital. We “decided we needed to do something to show our appreciation,” Longstreet said.

From H2M Architects + Engineers employees at a job site in protective helmets and masks to fashion forward real estate agent Rudy Rodriguez donning disposable boot covers and carrying hand sanitizers, businesses and employees put safety first.

So, yes, while the pandemic may have crimped many personal styles, Long Islanders looked haute, or cool, as they put their best face forward and performed their jobs.

— Leema Thomas

Camaraderie

From shared workspaces to chitchats, Long Island employees missed aspects of being in the office that ranged from the mundane to the esoteric.

Birthdays, baby showers, office parties.

A thriving workplace is also one that’s convivial.

Chit-chats around the office water-cooler or copy machine sharing morsels of gossip can help build camaraderie and foster career growth. But the pandemic put a kibosh on in-person, face-to-face office bashes and gatherings this year.

Those working remotely perhaps sorely missed their “work spouses” and suffered a bout of anxiety after their sudden separation from their work partners and shared workspaces during the lockdown, and what they missed most about the office ranged from the mundane to the esoteric.

— Leema Thomas

Connecting

For countless remote workers, virtual video conferencing has become the primary link to staying in touch with colleagues and managers.

OK, Zoomers! (Now, that’s a compliment!)

For countless remote workers, virtual video conferencing has become the primary link to staying in touch with colleagues and managers.

Chances are if you are a non-millennial, you needed a lesson or two on how to get the lights, camera and audio going. Perhaps seeing a sea of faces on your desktop or laptop monitors made you jittery, and you made a mental note to comb your hair and put on a clean T-shirt the next time. Or, perhaps, you’ve committed a few Zoom faux pas (wait, was that your toddler who walked in front of the camera crying “mommy” as you were about to clinch that deal?) or someone Zoom-bombed your meeting.

Love it or hate it, you have come to live with it and get on with the business.

Employees at Grassi Advisors & Accountants, EXIT Realty Achieve and Aurora Contractors were among businesses that connected with their staff via Zoom meetings.

Grassi employees from the Jericho, Ronkonkoma, White Plains, New York City and New Jersey offices stayed connected through weekly Zoom check-ins. Even the company’s CEO and managing partner, Louis C. Grassi, checked in.

But all work and no play make Jack and Jill quite dull people.

Employees of CN Guidance and Counseling Services gathered on Zoom for a game of scavenger hunt. And National Consumer Panel’s employee engagement committee held several virtual events, from virtual trivia to “Watercooler Chats” and bingo, to “boost morale and keep employees connected.”

Now, if you haven’t zoned out on Zoom sessions at least once, kudos. If you haven’t had your fill yet, “see” you later.

— Leema Thomas

A letter from

Newsday’s Publisher,

Debby Krenek

Flexible. Dedicated. Resilient. Words we’ve heard a lot over the past few months as organizations describe the challenging times they’ve faced during the COVID-19 pandemic. And it’s not just their businesses they’re describing, it’s also their workforce.

Be it with kids in their arms or pets at their feet, at make-shift home offices or on-the-go in their mobile offices, despite the many hurdles they tackle each day, employees at the Top Long Island Workplaces are learning to adapt to these unprecedented times.

Top Long Island Workplaces honor organizations where employees feel engaged, appreciated and empowered. Nominated by their own employees, these places of work are leading the way for others in the business community. All of us at Newsday feel privileged to be able to recognize organizations right here on Long Island, who are truly doing it right.

History has taught us that during times where we are tested the most, it is also a time of great opportunity. And though the pandemic has impacted business in many ways, where we go from here has yet to be written. Top honors today can help shape Long Island’s next chapter.

Congratulations to all of the 2020 Top Workplaces.

Grossé:

Grossé:

Posillico:

Posillico:

Milillo:

Milillo: