Meals on Wheels, the network of food delivery programs for seniors, has emerged as one of the most talked-about programs that could be affected by President Donald Trump’s proposed budget cuts.

In mid-March White House budget director Mick Mulvaney came under fire after he defended proposed cuts to Meals on Wheels, saying during a news conference the program is ”just not showing any results.”

“Meals on Wheels sounds great,” Mulvaney said, adding that “we’re not going to spend on programs that cannot show that they actually deliver the promises that we’ve made to people.”

Press Secretary Sean Spicer added fuel to the fire when he called the program, of which there are more than 5,000 local branches, “cute.”

The comments angered some, who argued that the program is crucial to keep senior citizens healthy and independent. In the following days politicians from both sides of the aisle spoke out against proposed cuts and online donations flooded the nonprofit Meals on Wheels America, according to program spokeswoman Jenny Bertolette.

Twitter lit up with criticism, too

@POTUS #MealsOnWheels feeds 500,000 veterans annually. You want to slash it. Each vacation to Mar-A-Lago cost more than MoW's annual budget

— Emanuel Zbeda (@therealezway) March 18, 2017

Meals on Wheels donations, volunteer sign-ups soar after Trump eyes cuts https://t.co/6fB4OXjMw5 pic.twitter.com/xHwIk8UDke

— CNN (@CNN) March 19, 2017

Going to Mar a Lago every weekend is "part of being president," Spicer says. Also dismisses Meals on Wheels funding concerns as "cute."

— Eli Stokols (@EliStokols) March 20, 2017

It is so disappointing that #trumpbudget does not value the work of Meals On Wheels and how critical they are to so many seniors. pic.twitter.com/DCeDiyfUl4

— Stop Trump 🍷 (@StopTrump2020) March 21, 2017

But the reaction from local organizations is measured

The county agencies that help fund the largest Meals on Wheels programs on Long Island and a handful of smaller community groups say they don’t rely on some of the programs that would be cut under the proposed budget, and they are uncertain how other budget cuts would impact them.

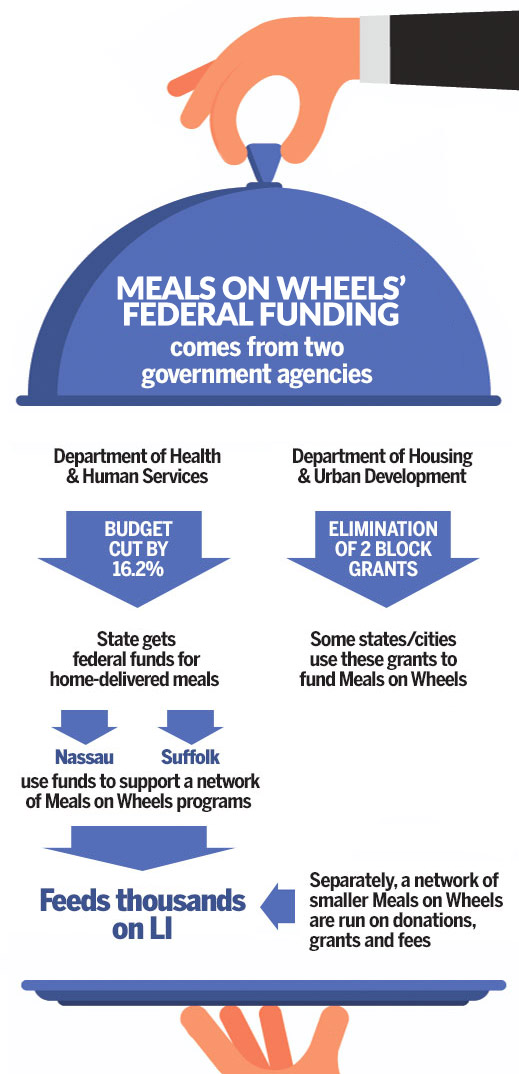

Under Trump’s budget proposal hundreds of millions of dollars would be slashed from the Department of Health and Human Services, which provides some of the funding for Meals on Wheels. The proposal also eliminates a $3 billion community block grant program, which some states and cities use to fund programs including Meals on Wheels.

On Long Island, more than 4,300 seniors use Meals on Wheels programs, officials said. Both Nassau and Suffolk counties receive federal money to disperse to a network of food-delivery groups, which also receive state and county aid. But unlike some Meals on Wheels programs in other parts of the country, none of that money comes from two of the federal block grants which would be eliminated under Trump’s budget proposal. This means programs overseen by the county “would not be zeroed out” but could still see a reduction in funding, said Holly Rhodes-Teague, director of Suffolk County’s Office for the Aging.

Federal funds for both counties come from the Older Americans Act, which falls under the Department of Health and Human Services, according to Greg Olsen, acting director of New York State Office for the Aging. Under the proposed budget, HHS funding would be cut by 16.2 percent, but the details of those cuts haven’t been released and it’s not clear if the Older Americans Act would be affected.

How the money trickles down

Still, “any cut is a concern,” Rhodes-Teague said.

Some programs throughout Long Island receive no government funding and operate on donations, grants and client fees, like Meals on Wheels in Huntington, East Hampton and Three Village (a network that operates in 10 North Shore communities). These programs and others like them would not be directly affected by proposed budget cuts.

Nonetheless, East Hampton Meals on Wheels president, Frank Eipper, said his organization received alarmed calls from seniors in the past weeks worried that meal service could be cut.

He has since had volunteers contact clients to reassure them delivery would continue, Eipper said.

The East Hampton organization delivers meals to between 30 and 60 clients. About 90 percent of their revenue comes from donations, Eipper said.

“Though we wouldn’t be directly affected by this, the concern we would have is that if the federal pot shrinks we’re going to be seeing more competition for donations,” he said. “If other programs ratchet up donation requests because they’re getting less money, it could make it tough for us.”

Marguerite De Bruyne, 89, of Amityville, receives five meals a week through a program run by Catholic Charities – one of the Island’s largest Meals on Wheels providers which relies heavily on federal funding, according to spokesman Umberto Mignardi.

De Bruyne said her eyesight is failing and she has a bad sense of balance. She relies on the service because she can’t afford a home aide.

“Without it I would have to rely on my daughter more and eat an awful lot of leftovers,” De Bruyne said. “I think it’s a great advantage for me.”