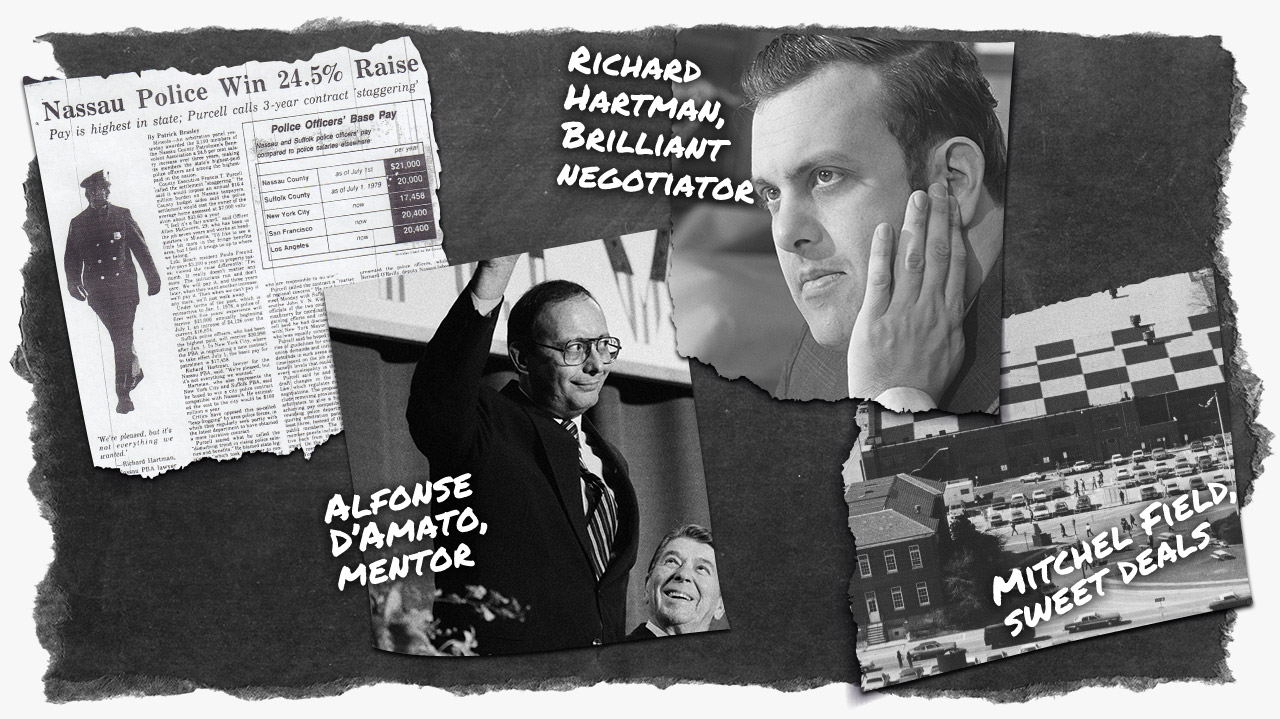

Deals, cop contracts: Learning from the masters

Gary Melius gains two great mentors and begins his own rise

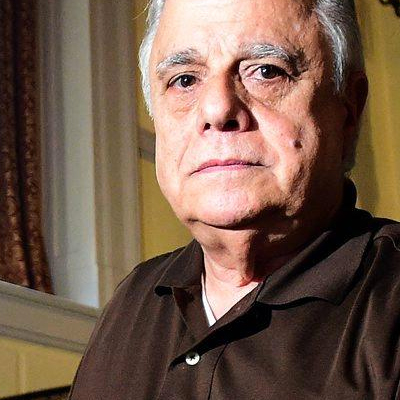

In the years after 1974, when he put his last criminal conviction behind him, Gary Melius launched a career that saw him buy, sell, renovate, build and manage more than a million square feet of property. At critical moments, he received public help worth millions of dollars from officials to whom he gave campaign contributions and favors.

During the same period, Melius’ first great mentor, the late lawyer Richard Hartman, negotiated a series of police contracts unprecedented in their generosity that to this day inflate Long Island’s outsized taxes. Last year, 1 in 4 officers in the two county departments, or more than 1,300, earned over $200,000. In New York City’s department, which is 10 times larger, the comparable figure was 48, or 1 in 1,000.

And another major Melius ally, Alfonse D’Amato, after a controversial tenure as Hempstead’s presiding supervisor, won election to the U.S. Senate in a giant upset.

D’Amato toughed out an investigation into kickbacks by town employees to the Republican Party; allegations of favoritism in placements into subsidized housing in his hometown, Island Park; and a district attorney’s report that concluded politically connected developers had received below-market leases on valuable properties in Mitchel Field. In 2003, the U.S. courthouse in Central Islip was dedicated in his name.

In the go-go period between the mid-’70s and mid- to late ’80s, each of these men struck out audaciously, catapulting themselves beyond all expectations.

The deals and practices of the time illuminate how the burgeoning suburban landscape of Long Island became home to a brand of politics usually identified with big-city machines. It featured a kickback regime in which government workers in Nassau paid the Republican organization 1 percent of their salaries in exchange for raises or promotions; the rewarding of political contributors, connected lawyers and favored contractors with government largesse worth millions; and the power of emerging public unions over political careers at contract time.

For Hartman and D’Amato, the decade marked a coming of age.

For Melius, the decade held a neophyte’s education in a system he fit into well, in no small part because he made his connections to Hartman and D’Amato just as they were leaving indelible marks on Long Island.

Desmond Ryan, the now-retired executive director of the Association for a Better Long Island, the real estate industry trade association, found that despite experiencing Melius’ wrath at times, he had to give him his due. What he recognized, in a way, was something akin to Hartman’s brainpower and D’Amato’s guile.

“He methodically reinvented himself,” Ryan said. And that, he concluded, “in itself is an act of genius.”

Melius and his mentor

Melius moved his construction business to the ramshackle two-story stucco building at 300 Old Country Rd. in Mineola where Hartman, the insomniac lawyer who represented him, ran his law office 24 hours a day in a near-crazed manner.

The office was a beehive. There were up-and-coming attorneys, like Anthony Capetola and Michael Axelrod, who eventually became political players. And there was a rolling cast of characters, including a Republican committeeman who eluded jail, with Hartman’s help, after he drunkenly crashed his car into a supermarket and stole $881.

Melius hung out at Hartman’s law office, too, and met his future wife, Pamela Robb, an office secretary and an NYPD sergeant’s daughter.

Hartman and Melius — both gamblers — became confidants.

Patricia Motamed, Hartman’s former girlfriend and secretary, said she remembers Melius answering Hartman’s calls from Atlantic City asking for cash when he was on gambling benders. “Sometimes, when the losses got so great, he would call up Gary, and Gary would fly down with a satchel of $250,000,” she said.

James Mileo, a Nassau cop who was arrested with Melius in 1971 in an extortion case, said he once witnessed Melius, at Hartman’s request, retrieving $500,000 from Hartman’s home to take to him when he was hospitalized.

But when dealing with politics and his union clients, Hartman’s political acuity and canny negotiating skills were unrivaled, and Melius was there to take it all in.

Long-lasting cost of police contracts

Public employee unions were new to Long Island in the late ’60s. Few people had experience negotiating union contracts. Hartman, though, learned fast and won a succession of benefits from willing politicians who understood the unions’ growing political power.

In 1969, Hartman landed the Nassau PBA as a client through his father, a well-connected Republican politician, according to longtime labor lawyer Thomas Lamberti. He soon proposed not just pay increases, but also costly benefits buried in the fine print, like a reduced workweek — a critical detail not made public until after it had been approved.

Over the years, the print only got finer — additional night differential, more overtime opportunities and unused time added to pension calculations.

By 1975, police costs had increased by 250 percent in only five years, forcing a near-record property tax hike. A Newsday analysis found that the Nassau police ranked lowest in days worked and highest in pay among the country’s 24 largest departments. The combination of a 59 percent pay increase over the previous five years and a reduction of 29 workdays fueled the skyrocketing costs even as crime rates were dropping. It got to be too much for Ralph Caso, the Republican county executive. But, with powerful support from D’Amato, then the Hempstead Town supervisor, the GOP-controlled board of supervisors wrested contract negotiations from him, and the police unions staged sickouts and packed board meetings. Francis Purcell beat Caso in the next Republican primary.

Hartman, D’Amato and the GOP flourished, with the police unions standing by them. The Suffolk PBA followed suit, hiring Hartman and winning comparable pay and benefits.

Soon the New York City PBA was knocking on Hartman’s door with a $750,000 retainer.

“That changed everything,” Motamed said. “The money just started rolling in.”

For Long Island taxpayers, it started rolling out, with police negotiations often setting the pattern for talks with other government unions.

In more recent times, both the Nassau and Suffolk police unions have made modest concessions, such as in scheduling. In 2012, the Suffolk union agreed to a two-tiered pay scale, with new officers earning less. Still, such concessions have not had a major impact on the overall cost of policing on Long Island.

Even with some trims in union contracts, Suffolk faces a budget gap of about $150 million. Since 2012, it has eliminated 1,000 full-time government positions, as well as health centers and the county nursing home. Since 2000, Nassau has suffered the ignominy of having to have its budget overseen by a state financial control board, a measure usually reserved for the state’s poorest and most troubled cities and counties.

In December, the control board took the drastic step of ordering the county to make $18 million in spending cuts.

Last year, the county couldn’t provide the control board with definitive copies of its police and other union contracts. The county explained that the provisions, first engineered by Hartman in a maze of deals, were spread among too many contracts, codicils, side agreements and addenda.

Perhaps incongruously, it was Melius, in an interview with Newsday four years ago, who addressed the effect of the police contracts. “They shouldn’t be getting what they’re getting,” he said. “They’re robbing the public.”

Real estate portfolio

Melius said he became part of Hartman’s entourage in New York City, telling a Newsday reporter in 2014 that he was so vital to PBA representation that he had a parking spot at City Hall.

He became more entwined with Hartman in other ways. In 1975, Melius bought his building at 300 Old Country Rd., which was a prime location, for $332,000, sweetened by a $325,000 loan from Hartman, records show.

His real estate career began to take shape.

As was the case with other subsequent deals by Melius, 300 Old Country Rd. was the subject of transactions that on their face were hard to understand. In 1979, Melius sold the property for $69,000 to Capetola, Hartman’s partner and Melius’ lawyer or partner on other transactions.

A year later, Capetola sold it back to him for even less money — $54,000.

Real estate professionals say that sale prices on commercial properties sometimes depend not only on market value, but on occasion also can reflect strategies to minimize tax liabilities.

Melius demolished the building and erected a 76,000-square-foot office condominium complex. He would later offer the condos for $235 a square foot, which, if he was successful, would have brought in about $17 million. Records do not indicate how much he made.

Melius was on his way as a developer. He built a portfolio characterized by the sort of blandness that wouldn’t win architecture awards but was profitable in Long Island’s booming early ’80s market.

“It was timing and luck,” Melius told a Newsday reporter. “You bought something — the next day you sold it, and you made a million dollars.”

In Great Neck, he built six low-slung brown office buildings that he later described as “six of the ugliest buildings designed by man.” The law firm representing him on the development included Capetola; D’Amato’s brother Armand; Jack Libert, who was then also counsel to the Nassau Board of Supervisors; and Joseph Famighetti, a former member of the now-defunct Long Island State Parkway Police who over the years represented the Suffolk PBA, politicians and their family members.

Melius paid under $600,000 in 1984 for a property in Mineola where he built 44 condos, records show. He sold one unit to Famighetti for $130,000. If the others on average went for a similar price, the sales would have netted him $6 million.

In 1985, Melius paid $1.7 million for a site on Merrick Avenue in Westbury, constructed a squat office building and sold it in 1988 to his friend John Nasseff’s West Publishing company for nearly $12.8 million, according to property records. Famighetti, Melius’ longtime friend and sometime lawyer, served as West’s attorney.

Though Melius played down his acumen — he once stated in a sworn deposition, “I’m not too bright” — others noticed the opposite.

“He’s the smartest person in the room,” real estate broker Stephen Caronia said in an interview. “He understands people. He understands how they think. He understands their motives, and he’s got an innate, unteachable sense of how to get things done.”

Over the years, Melius built a web of more than 100 corporate entities, a typical tactic of smart real estate players that serves to contain the debt to individual properties. Sometimes, he changed ownership on paper, by transferring a property between two of his companies. Tax returns he submitted to the court when he sued his former accountant show large sums of money flowing into his companies and being quickly redistributed to affiliated companies.

Turning to various lenders

For financing, he established a collection of sources, from major banks to less conventional lenders.

Some were prominent banks, like the Bank of New York. Another lender was Ivan Kaufman, now chief executive of Arbor Realty Trust of Uniondale.

Melius has said he met the mortgage executive more than 25 years ago when Kaufman found space in the Westbury office building Melius had built.

Records show that Kaufman, who declined to comment for this story, has lent Melius more than $50 million through private companies he controls, even when Melius was going through tumultuous business times.

“When I first met Ivan, probably know him a year, he lent me $9 million without a document,” Melius said in a Newsday interview several years ago. “OK, two weeks later, he made the document.”

The loans involved Oheka Castle, which Melius bought in 1984, and other important properties.

Among Melius’ less conventional real estate partners was someone who ran a Long Island office of a brokerage that the Securities and Exchange Commission accused of running a phony “boiler room” stock operation, and who was later barred from any supervisory or ownership role in the securities industry.

Another partner was a key witness in an epic mob trial, later convicted of loan-sharking. Teddy Moss was Melius’ partner on a three-story walk-up at 157 E. 55th St. in Manhattan. Moss provided critical testimony in the ’60s trial in which Mafioso “Crazy Joe” Gallo, a tabloid staple, was convicted of attempted extortion and served 9 years before being gunned down in a brazen Little Italy rubout.

In an interview, Moss’ widow, Goldie, recalled family trips to Oheka and said that Melius settled accounts fairly with her after her husband’s death.

Among other lenders were Melvin Ditkowich and Vytautus Vebeliunas. Ditkowich figured prominently in an investigation of a New York City judge who was removed from the bench after arranging high-interest loans from Ditkowich to private clients in his chambers and not reporting his commissions to the IRS.

Vebeliunas, prominent in the Lithuanian-American community, beat a mortgage fraud charge in 1987 but was convicted in 1992 of stealing $8 million from the Lithuanian credit union he controlled, according to court records.

Melius’ holdings stretched at their most expansive from suburban Chicago, where he planned a 1,000-unit residential development, to Maryland, where he purchased an 800-unit apartment complex.

On Long Island, Melius bought and sold at least 13 properties.

From supervisor to senator

As Melius made his way, so did Alfonse D’Amato. He began his career in Hempstead Town, the heart of Nassau’s Republican machine, running political campaigns and catching the eye of the county Republican leader Joseph Margiotta.

Margiotta invited newcomers from the city to join Republican clubs, attend barbecues and lick envelopes; and he rewarded them with jobs, which he, rather than the county executive, controlled. In return, he expected loyalty. The party demanded kickbacks through a regimented system in which workers seeking promotions and raises paid the party 1 percent of their salaries.

The kickbacks were challenged in two court actions. In one, Nassau and Hempstead Town workers filed a class-action lawsuit demanding the return of money they had paid to secure jobs and promotions. In the other, federal prosecutors pursued a criminal case that resulted in the indictment of seven former or current Hempstead Town Republican officeholders.

In 1975, D’Amato was subpoenaed by a federal grand jury probing the 1 percent kickbacks. He testified that he couldn’t recall collecting such payments, and he was not among those indicted.

Years later, a note D’Amato had written surfaced. In it, he wrote that a sanitation worker’s raise would be approved “if he took care of the 1%.” In a 1980 interview, D’Amato defended the note, saying he was merely trying to help the worker. Of the 1 percent payments, he said, “It was a very common practice at the time.”

More than 1,000 Nassau and Hempstead Town workers seeking refunds came forward to say they had paid the kickback.

The Republican Party agreed to settle the class-action suit, returning money that the workers had paid in return for jobs and promotions. In the criminal case, three Hempstead Town officeholders were convicted of illegally soliciting political contributions from town employees.

D’Amato became supervisor when the Republicans used the tried-and-true political tactic of appointing loyalists to open elected offices so they could then run as incumbents.

Margiotta tapped D’Amato in 1969 to run for receiver of taxes. As described by D’Amato in his memoir, Margiotta named him to the powerful post of Hempstead Town supervisor 23 seconds after he was elected.

The position had become open when the incumbent, Purcell, had been elected presiding supervisor on the same ballot.

In those days, Nassau was run by a board of town supervisors rather than a county legislature. Each supervisor held a weighted vote based on his town’s population, and Hempstead was far and away the biggest town.

By 1977, D’Amato became presiding supervisor of Hempstead, which gave him the highest number of weighted votes on the county board.

From his hometown of Island Park to the deep corners of county government, sweetheart deals abounded during D’Amato’s tenure.

In Island Park, where he still held great sway, 21 poor black families were evicted from a building in 1975 after the village refused to issue permits for the landlord to rehabilitate it. The village replaced it with subsidized housing that was filled with politically connected residents, including the in-laws of D’Amato’s cousin, according to an audit by the U.S. Department of Housing and Urban Development.

Years later, in a civil lawsuit filed by the U.S. Justice Department, former Village Clerk Harold Scully said in a deposition that D’Amato was the behind-the-scenes mastermind in the episode, according to news reports of the time.

D’Amato frequently called with instructions, occasionally identifying himself only as “God,” according to the news reports.

At a news conference he gave as a U.S. senator, D’Amato said he had no role in any favoritism and praised the village. “It was a great effort on their part and a wonderful program for those families,” he said.

In a statement issued in 1990 by his press secretary, Zenia Mucha, D’Amato said, “Dredging up allegations that in fact are untrue and go back as far as 25 years is totally outrageous and doesn’t deserve a response.”

While supervisor, D’Amato placed Hempstead tax revenues in non-interest-bearing accounts at the Bank of New York when banks were paying 10 percent interest on deposits. A state grand jury, while handing up no indictments, issued a report in 1979 that found such deposits by tax receivers in Nassau’s town and city governments had cost taxpayers $6 million.

That figure was peanuts compared with the bargains given to the politically wired at Mitchel Field, a decommissioned air base owned by the county. In the late 1970s, Nassau officials started granting 99-year leases there.

An investigation by District Attorney Denis Dillon identified the leases as the biggest giveaway in Nassau County history, costing taxpayers an estimated $2.7 billion over the span of 99-year lease terms. D’Amato declined to be interviewed on this and other matters for this story.

Dillon’s report said D’Amato took charge by negotiating the first lease, with United Parcel Service, which set the standard for two dozen more, almost all arranged through politically connected lawyers, with below-market rents and highly favorable terms to the companies.

In the late ’70s and early ’80s, a market-rate rent on such a deal was $20,000 an acre, former Nassau Deputy County Executive James Nagourney said in an interview. UPS leased the property for about $9,500 an acre, with annual rent escalators of 5 percent, rather than the standard 10 percent.

The Nassau Board of Supervisors approved the lease. As presiding supervisor of the largest town, D’Amato had the most votes on the board under the weighted system, and no lease could be approved without him.

D’Amato said his office had “absolutely nothing to do with the leases” and described Dillon’s report as “totally inaccurate.”

But in a recent interview, Nagourney, who was deeply involved in the Mitchel Field project, said he was still troubled by the lease, which he described as a “giveaway.”

“The whole pattern for Mitchel Field was set by D’Amato,” he said.

None of this stood in D’Amato’s way as he launched his remarkable challenge in 1980 to Sen. Jacob Javits, a liberal Republican icon. Some of it even helped.

Lawyers and developers involved with the Mitchel Field leases ponied up with contributions. Among them were William Cohn, Armand D’Amato’s partner; Margiotta; and Libert, who was then counsel to the board of supervisors. Among the developers were Wilbur Breslin, Alvin Benjamin and Nathan Serota. In that first campaign, they gave Alfonse D’Amato at least $16,500, or $47,000 in today’s dollars. By 1986, they had given him a total of at least $47,775, which would be worth $106,000 today.

The Bank of New York, where D’Amato had deposited millions in Hempstead Town funds in no-interest accounts, gave his campaign $130,000 in four no-collateral loans at 10.5 percent interest. The prime lending rate in 1980 ranged from 11.5 percent to 20 percent.

After federal authorities opened an investigation, D’Amato said he probably should not have sought the loans. No charges were brought.

Money mattered, but so did human capital. According to Republicans from the time, the police unions, mobilized by Hartman, turned out volunteers for phone banks and held rallies — a huge boost for a candidate running against the state party establishment. “Everybody was working,” said Lewis Kasman, who worked for Armand D’Amato and Hartman at various times.

Records from Alfonse D’Amato’s earliest Senate fundraiser show that nearly half the donors had ties to Hartman, including his brother-in-law, Bruce Alpert, who served as the campaign’s counsel.

In an interview, Kasman, who later turned federal informant after running mob-connected nightclubs, remembered breaking down donations into smaller amounts to evade federal limits. As for Melius, he “was always good for cash,” he said. D’Amato needed “walking-around money,” and Melius would provide it, he said.

Melius’ earliest contribution to D’Amato listed in available files shows him giving $1,000 in January 1980. From there, political donations became a way of life for Melius.

Melius also rented office space to D’Amato’s campaign at 300 Old Country Rd. in 1983, according to campaign records.

By D’Amato’s last campaign in 1998, filings show Melius and his family had cumulatively contributed a total of $17,000 to the senator, among the largest amounts tied to any individual donor.

That was a small part of at least $1.3 million in contributions made by Melius, his family, his businesses and employees to dozens of politicians over the decades. They would include at least $61,300 to then-Suffolk County Executive Steve Levy, $33,200 to then-Rep. Steve Israel, and $21,400 to then-Nassau County Executive Edward Mangano, among others.

Melius has given to Democrats, including Gov. Andrew M. Cuomo and Rep. Kathleen Rice; Republicans, like Rep. Peter King and then-President George W. Bush; Conservatives, among them then-Suffolk Sheriff Vincent DeMarco and then-Judge Ettore Simeone; and Independence Party members, like Brookhaven Town Clerk Donna Lent and Huntington Councilman Eugene Cook.

The number of beneficiaries and dollar totals are likely far higher because records for local campaigns are available only as far back as 2006 and state and federal records go back only to the late 1980s, leaving much of his record inaccessible.

D’Amato achieved his surprise primary win in 1980 after mocking Javits’ age and health, and he triumphed in the general election when the liberal vote split between Javits, then 77, who stayed in the race on the now-defunct Liberal line, and Rep. Elizabeth Holtzman (D-Brooklyn).

He held his celebration in Island Park, at Channel 80, a nightclub managed by Kasman and owned by Phil Basile, Kasman said. Basile was later convicted of conspiring with organized crime figures. His wife, Angela, contributed $2,000 and volunteered on the campaign, campaign records show.

Four years later, D’Amato was the sole character witness for Basile at his trial, where he was accused of conspiring with Lucchese capo Paul Vario to help secure parole for the mobster Henry Hill by setting up a no-show job. Hill’s life was portrayed in the movie “Goodfellas.”

After D’Amato left the stand, he embraced and kissed Basile. Basile was convicted and sentenced to 5 years’ probation, plus a $250,000 fine.

In a campaign debate in 1980, D’Amato was asked about Basile. He said Basile was someone “I had known as a hardworking family man.”

Cultivating connections

As D’Amato and Hartman surged, so did Melius. By 1983, he no longer listed himself as “contractor” on campaign contribution filings. Instead, he was the senator’s “Liaison for Police and Fire.” He boasted to Newsday that he negotiated the New York City PBA, fire and correction officers contracts, though the late James Hanley, who oversaw New York City’s labor negotiations at the time, said Hartman handled the talks himself. “Richie was a one-man band for negotiating contracts,” he said.

Melius worked hard to burnish his image and cultivate connections to Long Island’s elite. He joined the Better Business Bureau and supported charities, such as the Nassau Children’s House, winning a “Friend of the Youth” award. He listened in his car to tapes of the Rolling Stones and the “The Bodyguard” soundtrack, according to court records. But he found his way to the board of the Long Island Philharmonic, joining such members as Louis Fortunoff, then executive vice president of the Fortunoff jewelry and home goods chain; Raymond Jansen, then the publisher and CEO of Newsday; and Steven Sabbeth, then the Nassau Democratic leader and a close friend. Sabbeth later was sentenced to 8 years in federal prison for bankruptcy fraud.

Melius became an ample contributor to charity through the foundation he named for his mother, Elena, often avoiding public credit, because, he told Newsday, “then you’re doing it for a different reason.”

Three decades of Melius Foundation philanthropy

The “Oheka Cares” website says the Elena Melius Foundation has given away more than $2.8 million to nearly 500 recipients.

In one year alone, 2014, the foundation reported raising about $293,000 and giving it all away in grants. The beneficiaries included the Fire Marshal Benevolent Association of Nassau County, which received $1,000; the FBI Agents Association, which received $5,000; and the Pat Cairo Family Foundation, which received $1,000. The Cairo foundation was set up by Joseph Cairo, who is second-in-command in the Nassau Republican Party.

As an example of his low-key approach to giving, he recalled that when someone suggested inviting news coverage, he threatened to cancel a reception at Oheka he hosted for the divers who looked for bodies after the Flight 800 crash that killed 230 people off East Moriches in 1996. “I said, ‘No, then you’re not coming. I don’t want any publicity for it.’ ”

Richard Amper, executive director of the Long Island Pine Barrens Society, said Melius has given $72,500 since 2007, either by direct donations or reducing the rate for the group’s annual fundraiser at Oheka.

“I would say that he makes distinctions between people who can afford an expensive wedding and people trying to do the public good,” Amper said.

His good works also spread his name and helped him develop relationships.

“He enjoyed putting people together,” Nassau Democratic leader Jay Jacobs observed. “To him early on, I believe it was about wanting to be connected.”

Ryan, of the Association for a Better Long Island, saw much the same thing: “He has this affinity to latch onto people who have access to power.”

A life-altering purchase

Nothing loomed larger in these efforts than Oheka Castle, where he made his life-changing acquisition, buying the derelict estate in 1984.

Helping him was a vibrant woman named Allegra Capra. She was the former longtime girlfriend of Carmine “The Snake” Persico, boss of the Colombo crime family after its war with “Crazy Joe” Gallo and his brothers.

Capra ran North Site Realty of Syosset, which was financed by her later companion, Sam Scibelli, a Westbury auto shop owner. Scibelli, asked if he himself had organized crime ties, said, “There was no gangsters involved.”

According to Scibelli and Capra’s niece, Denise Rosner, Capra acted as the broker when Melius bought Oheka for about $1.5 million, with a $2 million mortgage from Ditkowich.

Local newspapers reported the purchase with photos showing Melius beaming with pride. A notation on the Oheka deed directs that it be sent to “Gary Melius, Esq.,” even though Melius’ formal education ended in the eighth grade.

Otto Hermann Kahn, a German-born financial adviser to the Rockefellers, constructed Oheka, an acronym of his name, in Huntington as an opulent getaway that surpassed all Gold Coast mansions. The estate included reflecting pools, stables, an 18-hole golf course and an airstrip, and for decades it was the second-largest private residence in America, appearing as Xanadu in Orson Welles’ film “Citizen Kane.”

After Kahn’s death, his widow, Addie, sold the castle and it fell into a disrepair that culminated when the Eastern Military Academy, which had made the castle its home, went bankrupt in 1979. The property was abandoned, and vandals left it in ruins.

Melius’ decision to purchase and renovate Oheka was a risk more experienced developers bypassed.

“That’s the gambler,” his friend John Nasseff said. “He takes chances. Your average businessman, before making a big purchase, consults with a CPA and an attorney. Gary acts right away.”

Melius continued buying properties. In 1986, he successfully bid $1.4 million for a shuttered pumping station in Freeport called the Brooklyn Water Works. He had hoped to convert the 19th-century Romanesque Revival structure with castle-like towers and arching windows into a condominium development, although years of trouble awaited.

Two years later, he entered the fortunate club of developers who secured bargain leases at Mitchel Field.

Melius paid $7.6 million to take over the lease at 107 Charles Lindbergh Blvd. from the warehouse of Webcor, a troubled manufacturing company, records show.

Under the leases, the county had no authority to renegotiate terms upon a sale. The omission of what is called a non-assignability clause, considered standard business practice, cost the county millions in lost revenue. But it was a developer’s windfall.

“I only paid those kind of dollars because of the lease terms,” Melius told Newsday at the time. “It’s a good deal for the buyer.” His lawyers were Libert, a member of Armand D’Amato’s law firm, and Joseph Carlino, the former Assembly speaker, who was of counsel to the law firm.

The broker who worked with Melius was Samuel A. Rozzi, the nephew of then-Police Commissioner Samuel Rozzi and Santa Rozzi, who was chief of the county’s bureau of real estate and insurance. The broker did not respond to a request for comment.

Asked at the time about his use of politically connected lawyers, Melius was incredulous. “Who would you go to — a nonpolitical lawyer?” he asked rhetorically. “Let’s be realistic.”

But it wasn’t long before Melius ran into trouble. The economy, and the real estate market along with it, was soon in crisis and office vacancies on Long Island topped 15 percent.

The building on Lindbergh Boulevard remained empty. But in a remarkable turn of fortune, the Internal Revenue Service agreed in October 1989 to rent the building for a decade for $1.7 million a year, according to court records.

At the time, D’Amato was on the Senate committee overseeing the IRS.

In contrast to his pragmatic comment about hiring politically connected lawyers like Libert, when the deal was announced, Melius said his connections had played “zero” role in landing the deal.

But it opened a few eyes in Long Island’s real estate community. Ryan, the longtime director of the industry’s trade association, recently observed, “You do not get institutional tenants like that without some kind of influence from somebody. That just doesn’t happen.”

Intro:

Intro: Video:

Video: Chapter 1:

Chapter 1: Chapter 2:

Chapter 2: Chapter 3:

Chapter 3: Chapter 4:

Chapter 4: Chapter 5:

Chapter 5: Chapter 6:

Chapter 6: Chapter 7:

Chapter 7: