Separate & Unequal

An 18-month Newsday investigation dug deep into millions of Nassau property records to reveal stark differences in tax bills and an assessment system weighted against the middle class and poor.

Taxes for this Syosset home have gone up

Meanwhile, taxes for this home next door went down

Sound unusual? It’s not.

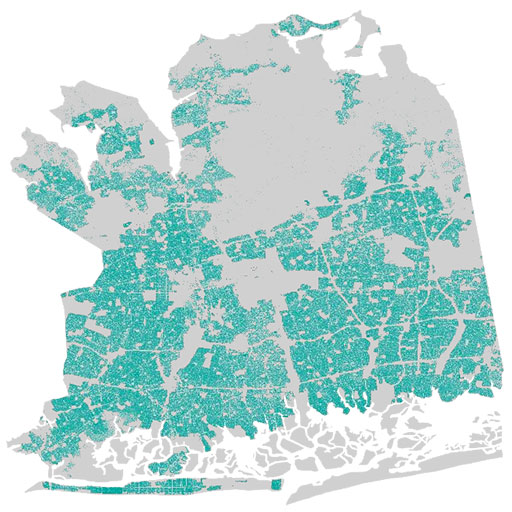

61% of Nassau property owners have appealed their property taxes and have typically seen decreases or modest increases.

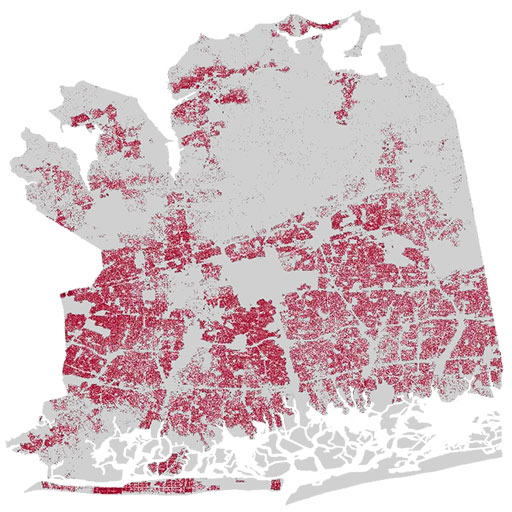

While 39%have not challenged their taxes and have typically seen their tax bills soar.

Among those with tax bill cuts

were nearly 11,000 properties

the county valued at $1 MILLION+

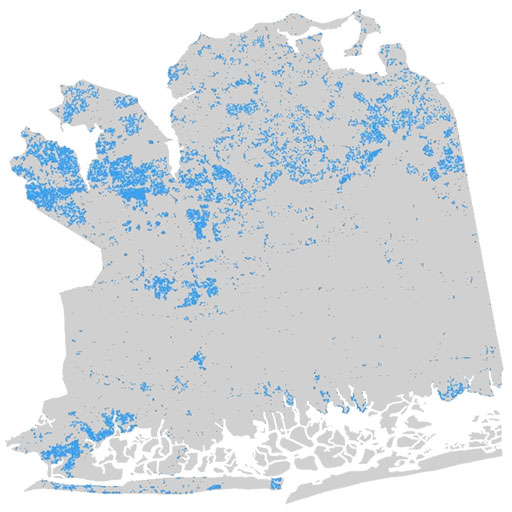

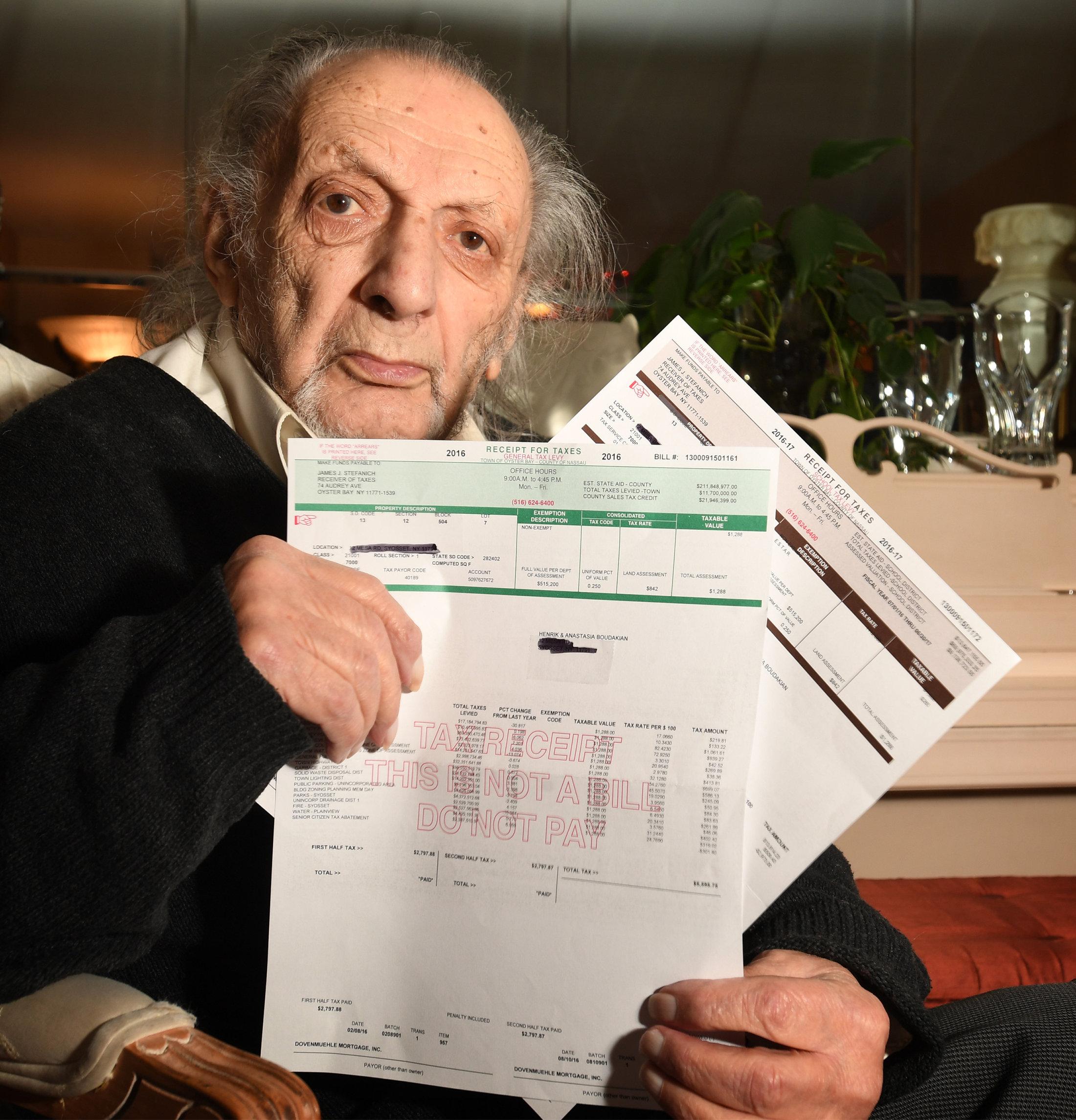

The burden shifted onto others including more than 6,400 middle-or-low income senior and disabled homes with tax bill increases of $2,400 OR MORE.

Homeowners in minority communities, who tend to file fewer challenges, are now assessed at a level 17% higher than properties elsewhere.

WHY DOES THIS HAPPEN?

The county, schools, towns and other governments need to collect enough money to fund their budgets.

One way they do this is by collecting property taxes.

Nassau officials have settled nearly 700,000 assessment challenges since 2010.

This saved challengers an estimated $1.7 billion in taxes.

But to balance their budgets, governments had to raise tax rates, shifting the burden onto those who didn’t grieve.

Tax bills of the typical property owner who appealed went up just $466, while the bills of those who didn’t increased $2,748.

And nearly half of the estimated savings, $789 MILLION, went to owners of

$1 million+ properties.

HOW DID THIS AFFECT YOU?

Read the Full StoryReporter: Matt Clark Design: Anthony Carrozzo, Matthew Cassella Development: Jon Ingoglia Photos: Thomas A. Ferrara, Chuck Fadely Production: Tara Conry