Senate Health Bill: What You Need To Know

The Senate Republican health care bill released Thursday faces an uncertain path as Majority Leader Mitch McConnell pushes for a vote next week before Congress leaves for the July Fourth recess. The bill, worked on in secret for the past several weeks, largely mirrors the House measure and has caused four Republican senators to balk at voting for it because it didn’t repeal enough of Obamacare and President Donald Trump called for negotiations.

Here’s how the bill compares to the the Affordable Care Act and House bill; and what could happen next:

Who is covered

Individual mandate

ACA: Individual mandate requires most Americans to have health coverage or pay a fine.

House bill: Instead of a mandate, insurers could impose 30% surcharge on people who buy a new plan after letting previous coverage lapse, giving healthy people an incentive to remain insured.

Senate bill: Individual mandate would be eliminated. Nothing would replace it as an incentive for healthy people to have insurance.

Employer mandate

ACA: Employer mandate requires larger companies to offer affordable coverage to employees.

House bill: Would eliminate employer mandate.

Senate bill: Would eliminate employer mandate.

Children under 26

ACA: Young adults could stay on parents’ health plan until age 26.

House bill: Unchanged.

Senate bill: Unchanged.

Paying for coverage

Imposed taxes

ACA: Imposed new taxes (including investment income and wages above $200,000) to help people pay for coverage.

House bill: Would eliminate most of those taxes.

Senate bill: Would eliminate most of those taxes.

Subsidies

ACA: Subsidies to insurers help people pay deductibles and copays.

House bill: Subsidies would end in 2020.

Senate bill: Subsidies would end in 2020.

Tax credits

ACA: Tax credits primarily based on income, age and geography to help low- and moderate-income people buy coverage via marketplaces.

House bill: Tax credits would be based primarily on age. Amount would not increase if premiums increase, and people in high-cost areas would get no additional money.

Senate bill: Tax credits primarily based on income, age and geography, but would cover a simpler plan. People would need to be lower-income than ACA to be eligible.

Pre-existing conditions

ACA: Pre-existing conditions could not be used as basis to deny coverage or raise premiums.

House bill: State could allow insurers to raise premiums based on pre-existing conditions if they had a gap in coverage.

Senate bill: Pre-existing conditions could not be used as a basis to deny coverage or raise premiums.

Costs for older people

ACA: Insurers could charge older people up to 3 times more than younger people.

House bill: Insurers could charge older people up to 5 times more. States can adjust ratio.

Senate bill: Insurers could charge older people up to 5 times more.

Pre-tax HSA

ACA: For pre-tax health savings accounts, individuals could contribute up to $3,400 and families up to $6,750.

House bill: Individuals could contribute up to $6,550 and families up to $13,100 to accounts, starting in 2018.

Senate bill: People could contribute more to their accounts than under ACA.

High-risk pools

ACA: Did not create high-risk pools.

House bill: Creates fund for high-risk pools. States would get $130 billion over 10 years to help sick people.

Senate bill: Creates fund for high-risk pools at $112 billion over 10 years. Aimed at reimbursing insurers to help sick people.

Changes to Medicaid

Funding

ACA: Entitlement program with open-ended, matching federal funds for all who qualify.

House bill: Would be funded by giving states a per-capita amount or block grant based on their spending, not adjusting for rising costs. Projected to reduce federal funding.

Senate bill: Would be funded by giving states a per-capita amount or block grant, starting in 2021. Amount projected to grow more slowly than in House bill, potentially reducing spending.

Expansion

ACA: States can expand Medicaid to cover people making up to 138% of poverty line, and federal government would pay a large part of the cost.

House bill: States would not be able to expand Medicaid after this year. In states that do expand by deadline, federal government would pay a smaller part of cost.

Senate bill: For states that expand Medicaid, federal government would pay a smaller part of the cost starting in 2021.

Other elements

Essential benefits

ACA: Insurers required to cover essential health benefits, such as hospital visits and mental health care.

House bill: States allowed to change what qualifies as an essential health benefit.

Senate bill: States allowed to change what qualifies as an essential health benefit.

Planned Parenthood

ACA: Planned Parenthood eligible for Medicaid reimbursements, but federal money cannot fund abortions.

House bill: Planned Parenthood would face 1-year Medicaid funding freeze.

Senate bill: Planned Parenthood would face 1-year Medicaid funding freeze.

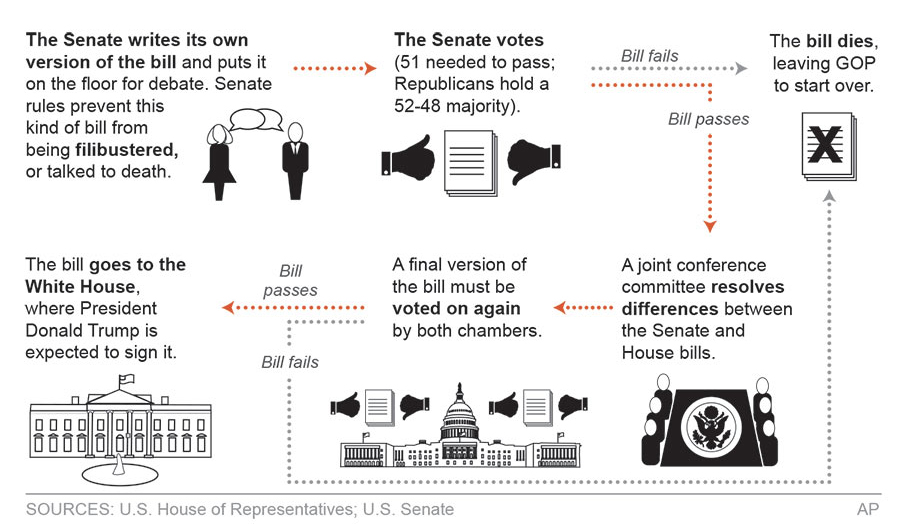

What’s next

–WITH TOM BRUNE | GRAPHIC BY THE ASSOCIATED PRESS